Exercise 10 13 Revising Depreciation Lo C2

Brief exercise 22 5 depreciation expense. Term spring 17 professor dr.

exercise 10 13 revising depreciation lo c2 is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark exercise 10 13 revising depreciation lo c2 using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

View homework help exercise 8 11 straight line partial year depreciation lo c2png from acc 201 at west chester university.

Exercise 10 13 revising depreciation lo c2. Selling plant assets c2 p1 p2 york instruments completed the following transactions and events involving its machinery. Since resco uses the straight line depreciation method its depreciation expense will be lower in the early years of an assets useful life as compared to using an accelerated method. Exercise 8 1 15 minutes invoice price of machine 12500 less discount 02 x 12500 250 net purchase price 12250 freight charges transportation in 360 mounting and power connections 895 assembly 475 materials used in adjusting 40 total cost to be recorded 14020.

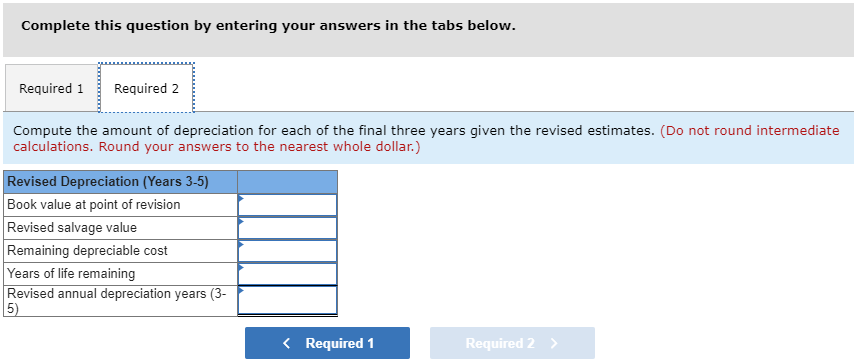

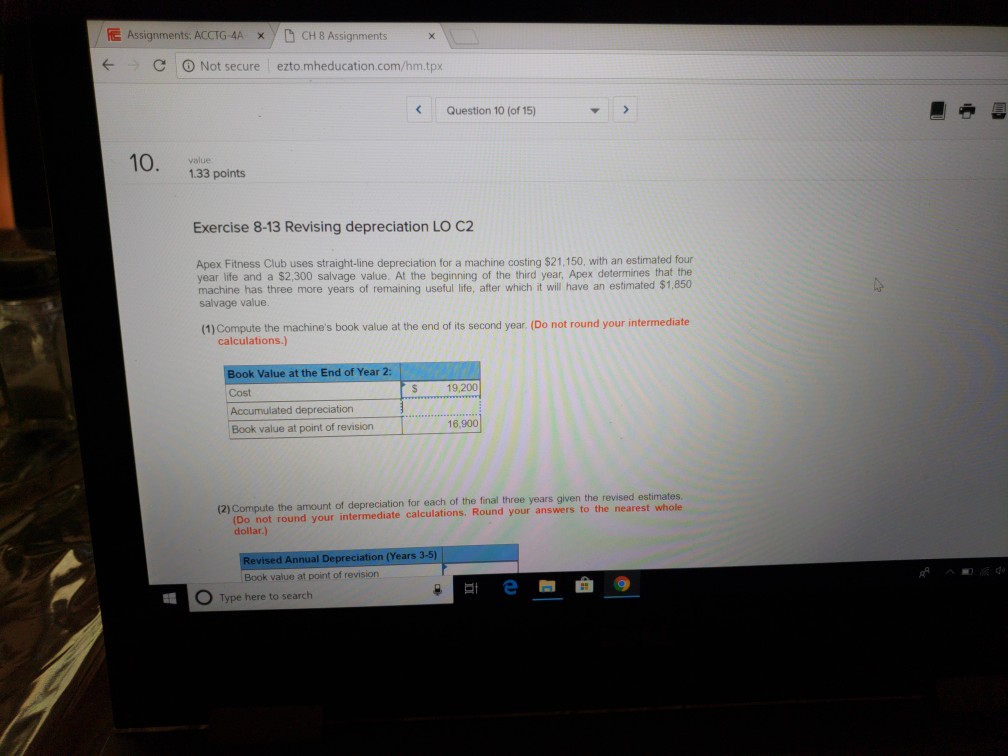

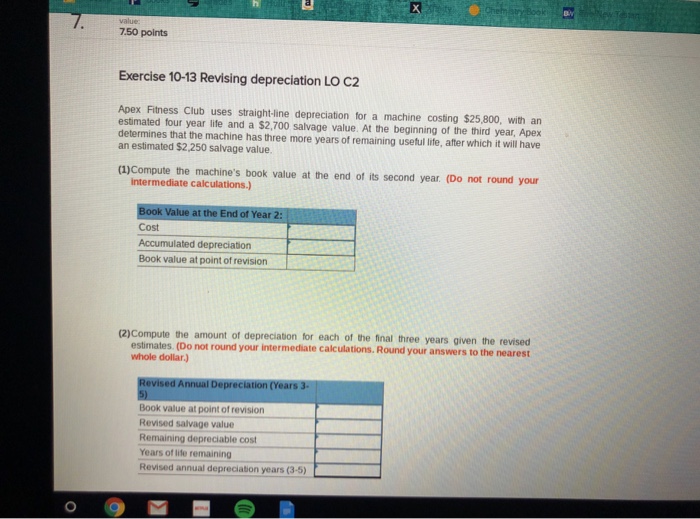

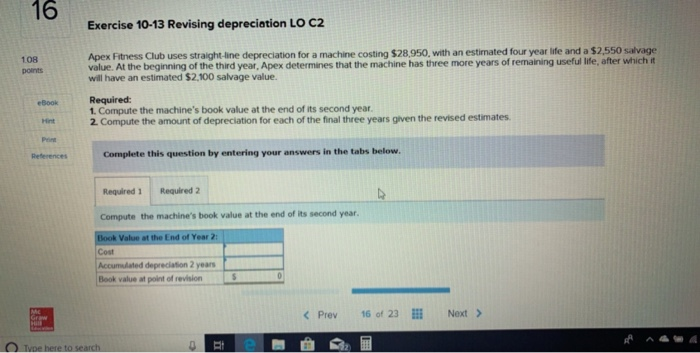

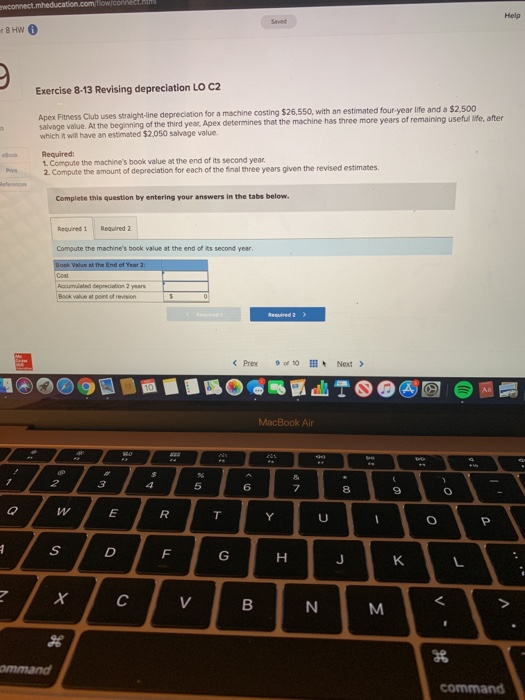

Problem 10 4b computing and revising depreciation. At the beginning of the third year apex determines that the machine has three more years of remaining useful life after which it will have an estimated 1750 salvage. At the beginning of the third year apex determines that the machine has three more years of remaining useful life after which it will have an estimated 1850 salvage.

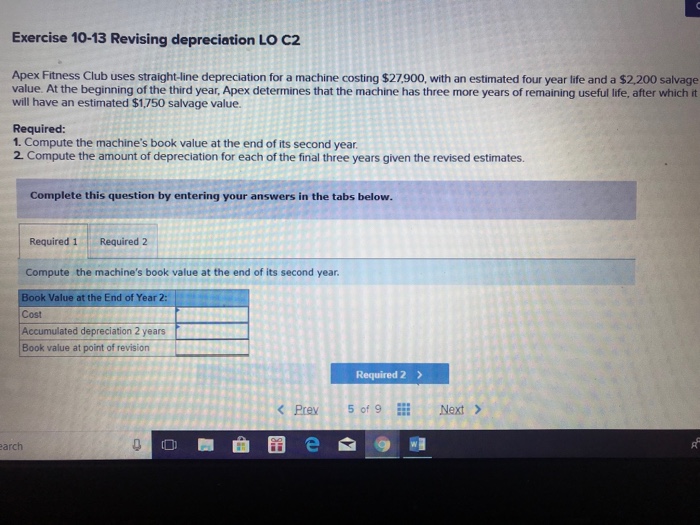

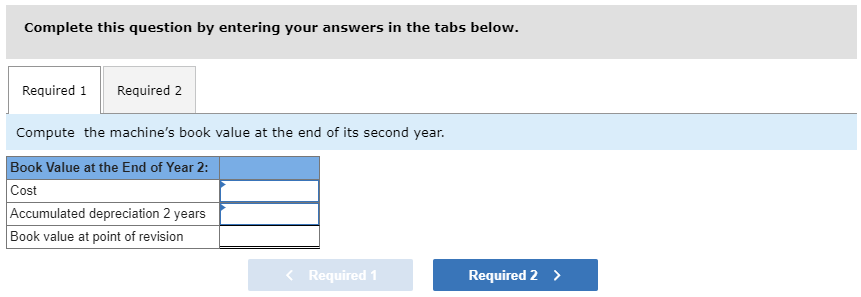

The salvage value remains unchanged. Exercise 10 13 revising depreciation lo c2 apex fitness club uses straight line depreciation for a machine costing 27900 with an estimated four year life and a 2200 salvage value. Exercise 22 13 1015 minutes a the net income to be reported in 2008.

Yapans depreciation expense in the early years of an assets useful life will be higher as compared to. Compute the revised depreciation for both the second and third years. Depreciation percentage 100 5 years 20 per year 2 40 cost of bus 40000 40 16000 year 1 depreciation problem 10 1.

12 exercise 10 13 revising depreciation lo c2 apex fitness club uses straight line depreciation for a machine costing 26550 with an estimated four year life and a 2650 salvage value. 1206 downloads 1024 views 279kb size report. 1 paid 107800 cash plus 6470 in sales tax for a new machine.

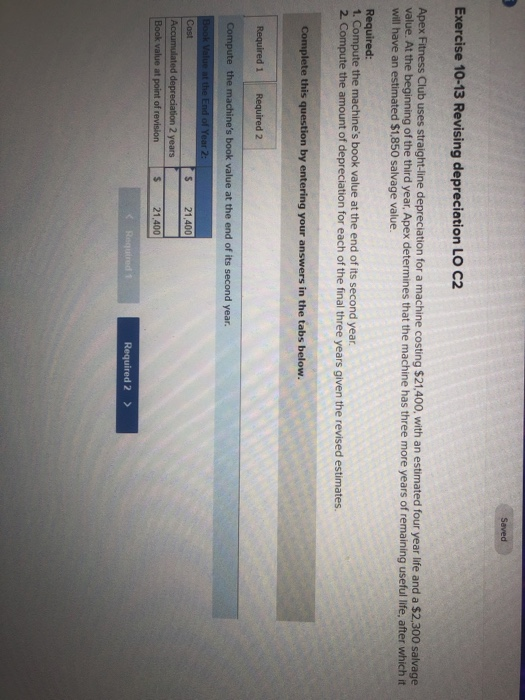

The machine is estimated to have a six year life and a 9720 salvage value. Exercise 10 13 revising depreciation lo c2 apex fitness club uses straight line depreciation for a machine costing 21400 with an estimated four year life and a 2300 salvage value. Apex fitness club uses straight line depreciation for a machine costing 23860 with an estimated four year life and a 2400 salvage value.

Solutions to chapter 22 lecture notes page. On april 1 2014 cyclones backhoe co. To calculate depreciation for the first year we would take 515 of the cost less salvage value of 36000 and get a 12000 depreciation for the first year.

Purchases a trencher for. 10 7 questions chapter 10 continued 21.

Solved Exercise 10 13 Revising Depreciation Lo C2 Apex Fi

Solved Exercise 10 13 Revising Depreciation Lo C2 Apex Fi

Solved Exercise 10 13 Revising Depreciation Lo C2 Apex Fi

Solved Exercise 10 13 Revising Depreciation Lo C2 Apex Fi

Solved Exercise 10 13 Revising Depreciation Lo C2 Apex Fi

Solved Exercise 10 13 Revising Depreciation Lo C2 Apex Fi

Solved 7 Exercise 8 13 Revising Depreciation Lo C2 1 66

Solved Apex Fitness Club Uses Straight Line Depreciation

Solved Apex Fitness Club Uses Straight Line Depreciation

Exercise 8 11 Straight Line Partial Year Deprecia

Exercise 8 11 Straight Line Partial Year Deprecia

Units Of Production Depreciation Choose Numerator Choose

Units Of Production Depreciation Choose Numerator Choose

Acc Homework Chapter10 Exercise 10 11 Straight Line

Acc Homework Chapter10 Exercise 10 11 Straight Line