Exercising Deep In The Money Calls

You may lose some extrinsic value in your call option but you may gain a lot more from the special dividend payment. To be frank with you all due respect i dont understand why people write deep in the money calls compared to the risk they takemay be i will understand in due course when i try myself.

exercising deep in the money calls is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark exercising deep in the money calls using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

One common situation is a dividend or a special dividend announced by the stock.

Exercising deep in the money calls. The option you were short had a delta close to 100 for puts and 100 for calls. An option can also be in the money or at the money. I have seen auto exercising once but am not sure if other brokers do this.

With a stock option on a share that pays a dividend it can be worth exercising a call in order to collect the dividend. Deep in the money options expiring what happens. The price will never be less than the intrinsic value and transactions costs for options are less than for stock so you should never exercize unless you want to keep the stock.

Lets say that i bought rimm stock at 7500 back in april when a short put was assigned. An option is said to be deep in the money if it is in the money by more than 10. So why do options get exercised early at all.

A call option is otm if the underlyings price is below the strike price. This phrase applies to both calls and puts. A deep in the money andor b very close to expiration.

Definition of deep in the money. So deep in the money call options would be calls where the strike price is at least 10 less than the price of the underlying stock. I have two deep in the money visa calls.

It is a worthwhile effort to do the math on exercising an option early. I asked the question to assess what is more profitable while writing deep in the money calls. Its not quite true that you never would.

The answer is that it generally does not make sense unless the option is. If do nothing i believe that your broker is under no obligation to do anything. In options on futures.

A put option is otm if the underlyings price is above the strike price. So when you find out youve been assigned and that it creates a cash flow issue you call your broker and either sell the long stock and sell another less deep in the money put or buy back the short stock and sell a less deep in the money call. When the holder of that call or put option has an option that is in the money and decides to buy or sell the stock it is said that he is exercising his option.

Otm options are less expensive than itm or atm options. Definition of exercising options. You should be able to sell or buy deep in the money calls though they are not as liquid as at the money options.

Now it may be worth exercising a long call option before expiration to take possession of the stock. Out of the money means an option has no intrinsic value only extrinsic value. Calls and puts give the owner the right to buy or sell a stock at a certain price by a certain date.

The call doesnt give a right to the dividend but owning the shares does.

The Importance Of Time Value In Options Trading

Early Option Exercise Never Say Never Sciencedirect

Early Option Exercise Never Say Never Sciencedirect

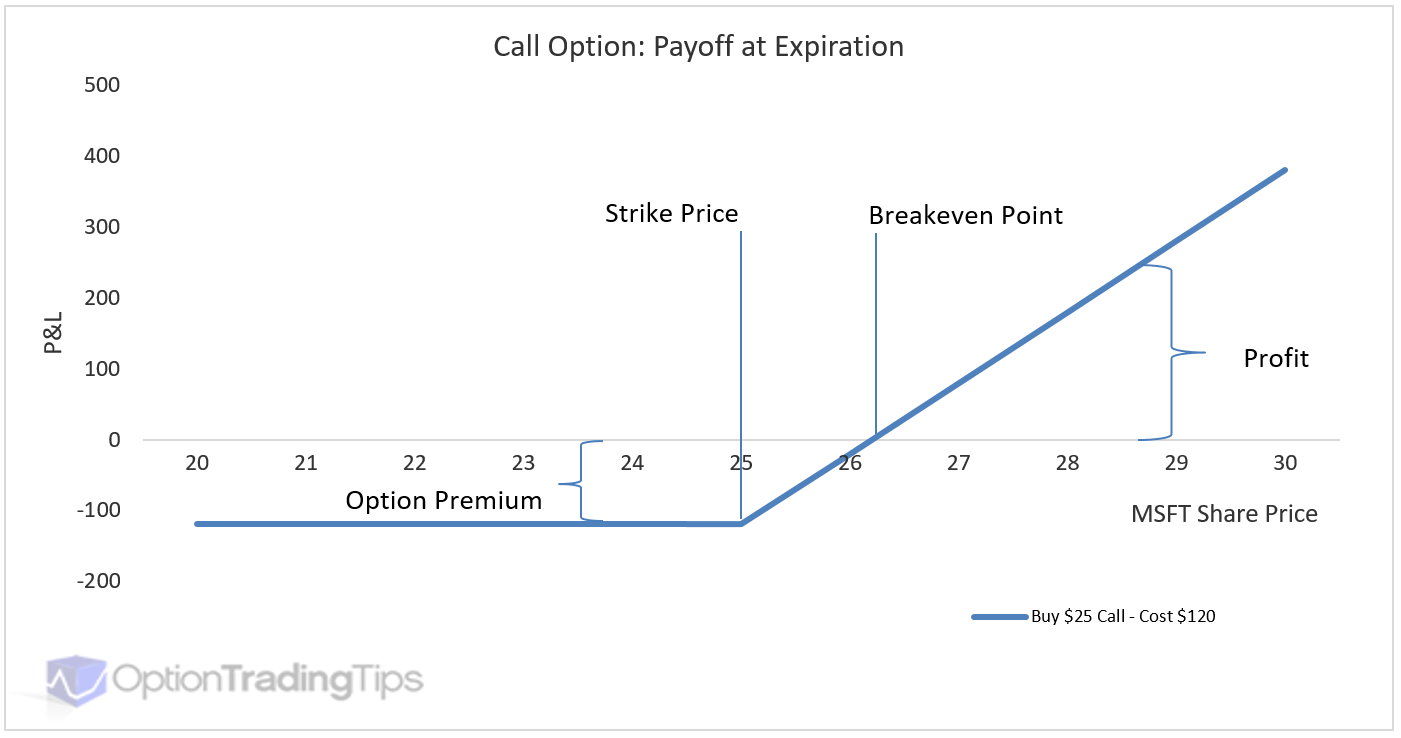

Understanding Option Payoff Charts

Understanding Option Payoff Charts

Early Option Exercise Never Say Never Sciencedirect

Early Option Exercise Never Say Never Sciencedirect

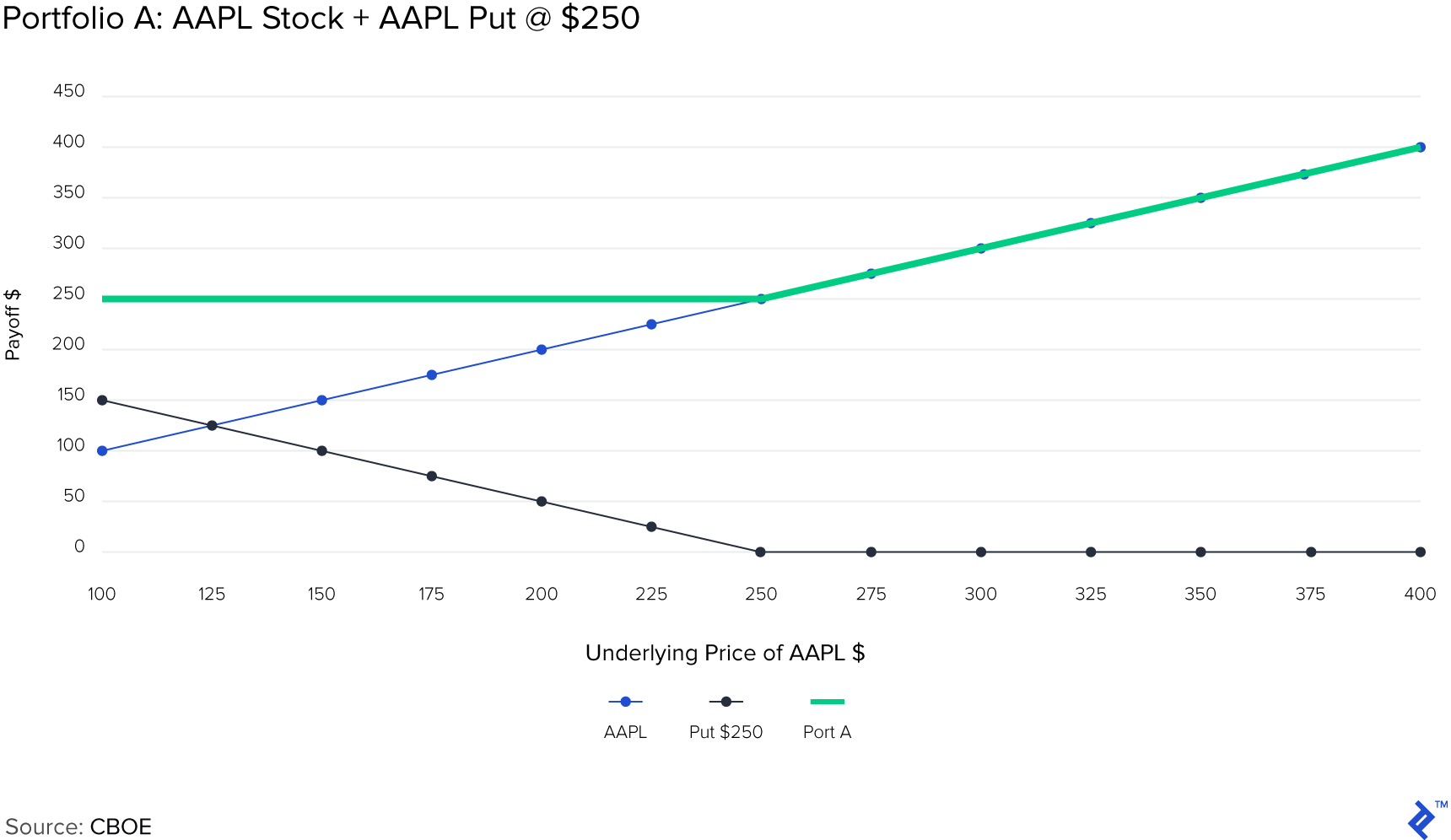

Option Pricing The Guide To Valuing Calls And Puts Toptal

Option Pricing The Guide To Valuing Calls And Puts Toptal

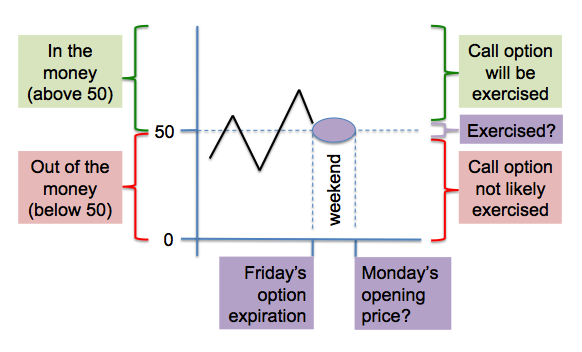

European Vs American Options Quantopia

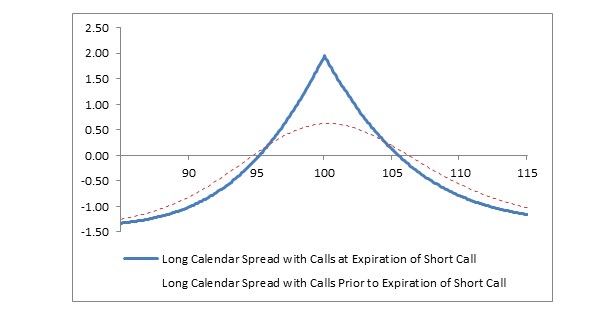

Long Calendar Spread With Calls Fidelity

Long Calendar Spread With Calls Fidelity

The Importance Of Time Value In Options Trading

/77005273-5bfc2b8d4cedfd0026c11921.jpg)